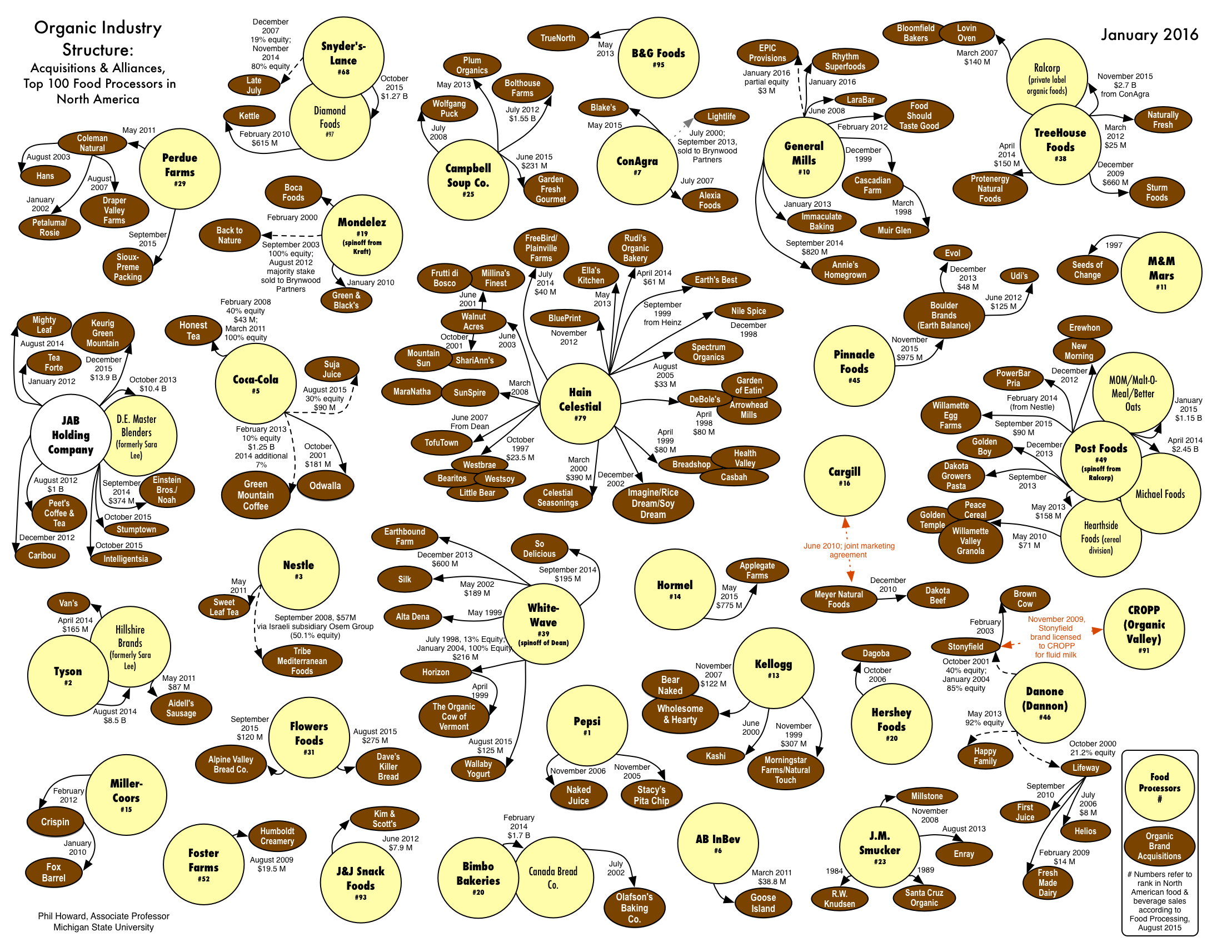

Just as we shared an infographic with you on the few companies that seem to own all the conventionally grown food in the world, we’d like to share one with you showing who owns our organics. You will, no doubt, be surprised and unhappy to see some of the names.

The first wave of acquisitions of organic processors was concentrated between December 1997 and October 2002. This period coincides with the initial release of the draft USDA organic standards and its full implementation in October 2002. A second wave of acquisitions in the organic sector has been occurring since 2012. Surprisingly few major corporate agribusinesses note ownership ties on their acquisitions’ product labels.

The first wave of acquisitions of organic processors was concentrated between December 1997 and October 2002. This period coincides with the initial release of the draft USDA organic standards and its full implementation in October 2002. A second wave of acquisitions in the organic sector has been occurring since 2012. Surprisingly few major corporate agribusinesses note ownership ties on their acquisitions’ product labels.

Dr. Phil Howard, an Associate Professor in the Department of Community Sustainability at Michigan State and author of the infographic above, has identified some significant updates to his Who Owns Organic Chart, including:

- Hormel’s acquisition of Applegate Farms for $775 million

- WhiteWave’s acquisition of So Delicious/Turtle Mountain for $195 million and Wallaby Yogurt for $125 million

- General Mills’ acquisition of Annie’s Homegrown for $820 million

- Pinnacle Foods’ acquisition of Boulder Brands (Earth Balance, Evol, Udi’s) for $975 million

- Post’s acquisition of a number of cereal and egg brands (including MOM/Malt-O-Meal/Better Oats) for $1.15 billion

- JAB Holding’s acquisition of a number of coffee brands (Green Mountain Einstein Bros./Noah’s, Stumptown and Intelligentsia, Peet’s, and Caribou)

Dr. Howard also created the chart, Organic Industry Structure: Major Independents and Their Subsidiary Brands. The independent brands include:

- Alvarado Street Bakery

- Amy’s Kitchen

- Bob’s Red Mill

- Cedarlane

- Clif Bar: Luna

- Eden Foods

- Equal Exchange

- Frontier Natural Products: Simply Organic

- Lundberg Family Farms

- Nature’s Path: Country Choice Organic, Enviro-Kidz

- Organic Valley: Organic Prairie

Pacific Natural Foods(Campbell Soup acquired Pacific Natural Foods in 2017)- Sno Pac

- Springfield Creamery: Nancy’s

- Traditional Medicinals

- Yogi Tea

Dr. Howard observes, “I expect more deals to occur, since organic foods sales continue to increase faster than sales of conventional foods, and corporations are flush with cash and/or access to cheap credit.”

The Cornucopia Institute has aided Dr. Howard’s work with the sharing of research and information over the years. “We are proud to have helped Dr. Howard update this important infographic that so many consumers find to have value,” said Cornucopia Codirector Will Fantle.

A big thank you to The Cornucopia Institute for putting the list together.